3 Tips That Help Us Earn 175k+ Points a Year

(That don't require you to open new credit cards or spend endlessly.)

After last week’s vulnerable and more philosophical post, I figured it was time for a more tactical one. Let’s get right to it:

In 2024, my husband and I clocked in close to 175,000 points across our various cards. Lest you think that we have a shopping addiction (I promise we don’t; we don’t even have Amazon Prime), or that we made a major purchase, nearly every one of those points came from everyday spending.

To be clear: We didn’t spend $175,000 to earn 175k points, and it’s a myth that you have to spend a lot to make meaningful gains on your points balances. And yes, while this is easier to do with a partner, you could replicate the methods below and still amass quite the stash o’ miles.

As I’ve shared before, points are some of the most valuable travel perks out there: They’ve enabled us to roam far and wide without worrying about flight costs, book hotels in emergencies we otherwise wouldn’t have found, and to redeem them for family when needed.

(An aside: It’s a shame that Congress members have introduced the “Credit Card Competition Act” to essentially kill credit card reward programs, which are currently funded by the fees that merchants pay. And at the same time, I sit with the tension of knowing that only those with access to credit can reap the rewards in the first place, and that increasing fees so that select consumers can reap said-rewards isn’t a fair game. But I maintain that if we’re trying to make things better for all consumers—many of whom are already stretched thin for other reasons—axing reward programs isn’t really the solution nor should it be the priority. Anyway, I digress.)

So, as individual consumers who love travel (read: those with credit cards who book trips), having access to mileage programs and point redemptions go a long way, if you know how to play the game. I’ll share my top tips that show how we got to 175,000 points in 2024—and how we’re on track for the same, if not 2x more, in 2025.

3 Tips for Racking Up 100k+ Points in 2025

1. Points for Shelter (Not in a Doomer Way…)

Given my work in personal finance, I see hundreds of budgets from readers. Nine times out of 10, the top line item in the ol’ budget is housing. The same applies to us.

As renters, we use the Bilt card to earn points for rent payments. (Not sponsored. I can only speak to my experience—but it’s been a good one so far.)

In 2025, Bilt plans to roll out points for mortgage payments as well, so if you’re lucky enough to own—praying to my lord Beyonce that I get to join your ranks someday soon—you can also benefit from a card like this one. We’ve had this card for 2+ years since October 2022, and we’ve earned 150k points in that time. We now have a balance closer to 100k after a redemption.

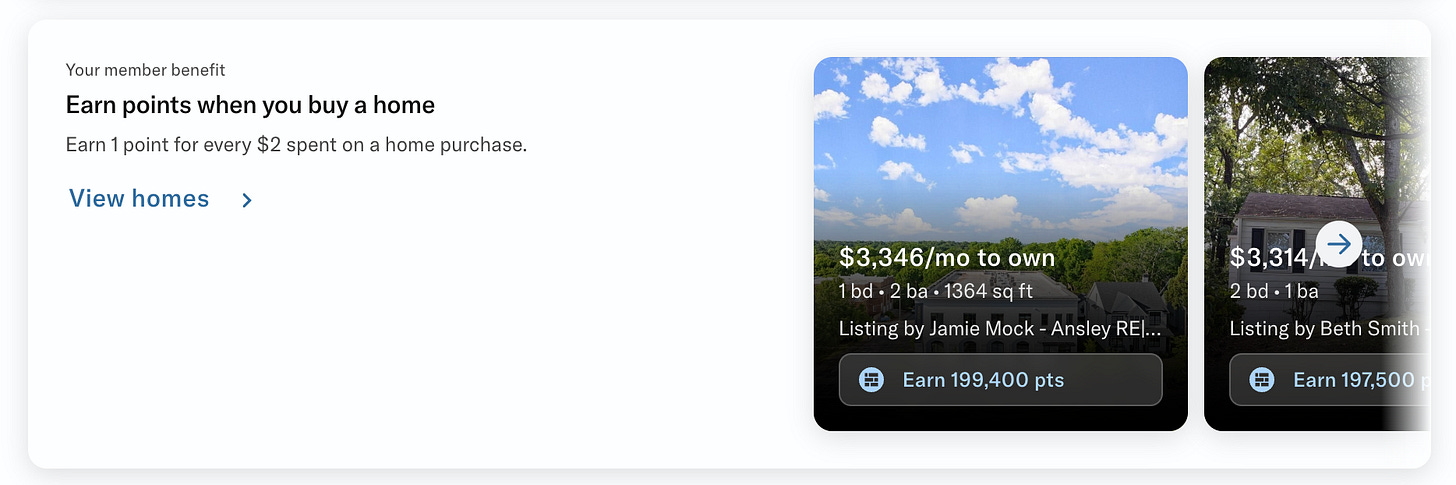

I also appreciate that Bilt offers 3x–6x point promos on Bilt Day (i.e., you’ll earn 6x the points for dining at local spots), points while buying a home, and cards you can link your account to for even more points. And when you go to redeem them, their list of transfer partners is solid, too.

This year, my husband and I hope to buy a home, and if the house we want ends up on the app where you can redeem 1 point for every $2 in value, we will definitely try to do so. (So for example, if we buy a house for $400,000, we could earn up to 200,000 points! Imagine that redemption; I squeal with excitement at the thought.)

TL;DR: The Bilt card helped us earn 50,000 points this past year (not all from rent, from regular shopping and multiplier promos too). Here’s my personal invite if you want to check it out; in exchange, I get 2,500 points but no other kickbacks or cash. I always promised to be honest about referrals!

2. The power of Rakuten

When I first joined Rakuten, my main focus was cash back for online purchases. Through 2023, I made about $300 back. But Rakuten eventually partnered with American Express, so that you could earn your cash back in Membership Rewards instead at a 1:1 ratio.

I finally made the switch over to the Membership Rewards payout a year ago, and in the 12 months since, we’ve racked up 56,854 points.

If we hadn’t switched, that would have been about $570 in cash back, but 57k points for us could be two roundtrip flights to Europe or multiple domestic roundtrips, and that felt more worthwhile than cash in our pocket.

The best part is: This was for online purchases I already needed to make. I’m not big on shopping—like I said, I’m not an Amazon Prime girly. But through regular shopping at brands like PetSmart, Expedia, and Neiman Marcus (and therefore, Rakuten promos which are often 3%–20% cash back), I racked up a pretty points penny. If you’re interested, here’s my Rakuten referral, where a referral earns me 3,000 points.

3. Strategic credit card spending

I know plenty of people in travel groups who agonize over “optimal” spending: “I could buy this on the CSP for 4x points, but AmEx offers 5x the points, etc. But my 5% cash back on the Freedom might be better…”

Unfortunately, that life isn’t for me (though I respect their hustle); I find it too overwhelming and time-consuming to figure out. And extra kudos to those who laminate little guides of “which cards earn the most points every quarter” to keep in their wallet, or the aficionados who add stickers onto their cards. Y’all are impressive.

But, in any case, the lo-fi way I approach this is:

If it’s travel, I’m more likely to benefit from the 3x–10x points on Chase Sapphire Reserve, unless I’m trying to book a property available on AmEx’s Travel Portal.

If it’s restaurants, I’m more likely to book on my Chase Sapphire Reserve which offers 3x points (as opposed to AmEx Platinum’s 1x).

For other everyday spending or joint spending with my husband, I book with the AmEx Platinum which is the standard 1x point but has so many other perks. Sometimes, they also offer periodic “additional spending bonuses,” like “Earn an extra 10,000 points if you spend $2,500 this month.”

Thanks to our strategic spend here, we earned approximately 75k points in 2024.

Depending on your mix of cards—maybe yours have revolving bonus categories every quarter, or you’re trying to take advantage of a sign-up bonus—this system will vary. And if you really want to deep dive, you could grab The Points Guy’s Brian Kelly’s new book (How to Win at Travel) or sign up for a points consultation with a service like Point.Me or Straight to the Points.

Honorable Mentions

The most obvious way to rack up a ton of points at once would be lucrative sign-up bonuses. These have, seemingly, become less generous as the years go on; I was lucky enough to take advantage of the CSR’s 100k sign-up bonus back when they first launched, and now the standard is 60k–80k. But this also requires things like solid credit, credit checks, etc. so I don’t know if this is something I’d recommend unless you’re ready for the deep end. If you do want to know what’s out there, I check Nerdwallet’s roundup each month.

The other big one is online shopping portals via your loyalty programs. Before you shop, you’ll log in to your loyalty program’s portal, click the link associated with your frequent flyer account, and then shop from there. So for example, if I wanted to shop at Macy’s, I could use Virgin Atlantic’s shopping portal to earn 2x the points for Virgin Atlantic’s program and double dip, so I can earn points from my card, too. I use Cashback Monitor to find the best bang for my buck.

And there you have it! As you can see, we’re not earning millions of miles from business trips, signing up for every credit card under the sun, or compulsively shopping our way to Disney World. But we are able to grow our little points pot each year (or, at the very least, “offset” the ones we use)—and that easily adds up to thousands of dollars in free travel.

If you have other tips or tricks for racking up miles, please share them! Knowledge is power, and in this case, points.

❤️🩹 It would be remiss of me not to point out how changes and cuts in staffing are leading to some serious issues in the travel industry, especially regarding the recent crash at the end of January: “The US has a chronic understaffing problem in air traffic control.” I don’t say that to scare anyone, just that we should all be aware of the situation, especially as frequent travelers.

🚗 I don’t get motion sick in cars (just on planes, go figure), but my husband does. My brother showed us this Apple accessibility feature recently for “Vehicle Motion Cues” and said it really helped his girlfriend on a recent drive. As for my own motion sickness while flying, I rely entirely on Dramamine (sponsor me, Dram’!).

📚 My TBR pile keeps growing as I make my way through The Covenant of Water (yes, still, it’s 700+ pages, okay!?). On the list: Good Dirt by Charmaine Wilkerson, Homeseeking by Karissa Chen, and Isaac’s Song by Daniel Black. What’s on everyone else’s? I would love to know.

🎨 My favorite artist, who is also incidentally focused on social and environmental justice. These works are stunning and so full of meaning.

🔮 Coming up soon: Guest posts from the incredible and ! I can’t wait to share them.

This time next week, I’ll be in Florida celebrating 10 years together with my husband—the same place we went for our first-ever trip back in the day! How cheesy and cute. So in the meantime, sending love and a warmer, lighter February to all. xx

—Henah

ok, I'm curious how the Bilt card works for rent. Are you using the card to pay rent? Because I would LURVE to pay rent with a credit card, but the online portal where I pay requires a checking account (routing number/ acct nbr).

Whilst we don't have the same sort of rewards available in the UK for racking up points, it was really interesting to read. Thank you! I cannot wait to share the guest post in the coming months. Hope you have a wonderful time celebrating in Florida - Happy 10 years! ✨